This is to ensure the document can be read after it is permanently archived in the Recorders Office as required in the Arizona Statutes. The original deed document will need to be recorded in the county where the property is located* If money has transferred hands an Affidavit of Property Value must be filled out per ARS 11-1133 signed and notarized and recorded with the deed* If no money transferred hands than an exemption number must be placed on the face of the Deed ex B-3. The exemption num .

DocHub Reviews 44 reviews DocHub Reviews 23 ratings 100,000+ users

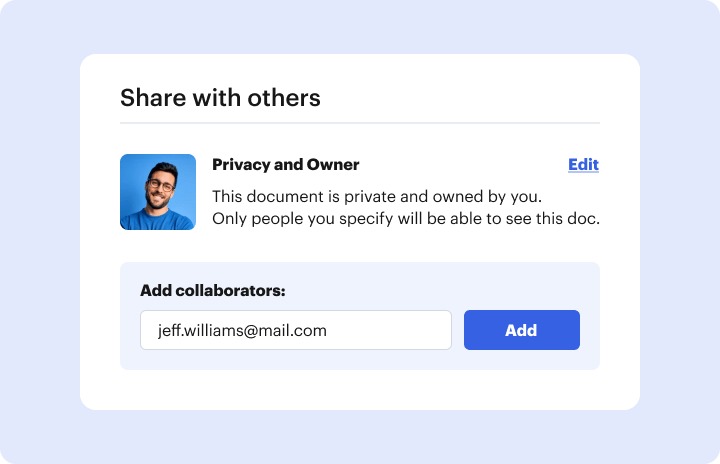

Send affidavit of property value arizona via email, link, or fax. You can also download it, export it or print it out.

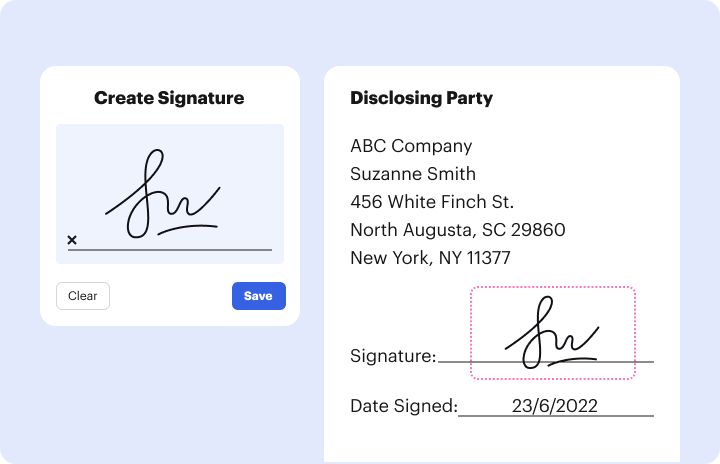

Adjusting documents with our extensive and intuitive PDF editor is straightforward. Follow the instructions below to fill out Az affidavit of property value online easily and quickly:

Benefit from DocHub, one of the most easy-to-use editors to promptly handle your paperwork online!

Fill out az affidavit of property value onlineWe've got more versions of the az affidavit of property value form. Select the right az affidavit of property value version from the list and start editing it straight away!

| Versions | Form popularity | Fillable & printable |

|---|---|---|

| 2019 | 4.8 Satisfied (50 Votes) | |

| 2003 | 4.8 Satisfied (23 Votes) |

We have answers to the most popular questions from our customers. If you can't find an answer to your question, please contact us.

Who signs Affidavit of value in Arizona?A.R.S. §§ 11-1133 and 11-1137(B) require all buyers and sellers of real property or their agents to complete and attest to this Affidavit.

Who determines the value of your property for the purposes of taxation in Arizona?Role of the County Assessor The assessor is responsible for identifying, classifying, valuing, and assessing all property under their jurisdiction that is not valued by the Department. See A.R.S. 42-13051 , 42-15052 , and 42-15053 . Such property includes agricultural, commercial, personal, and residential.

Who estimate the value of property so it can be taxed?Typically, tax assessors will value the property every one to five years and charge the owner-of-record the appropriate rate following the standards set by the taxing authority. Assessors calculate that value using the mill levy\u2013also called the millage tax\u2013and the assessed property value.

What is the purpose of affidavit?An affidavit is a sworn statement put in writing. When you use an affidavit, you're claiming that the information within the document is true and correct to the best of your knowledge. Like taking an oath in court, an affidavit is only valid when you make it voluntarily and without any coercion.

How do I get an Affidavit of Affixture in Arizona?Affidavit of Affixture Complete an application for Arizona Certificate of Title and Registration. . Submit a copy of the Affidavit of Affixture (Assessor or Recorder Office) Submit a lien clearance, if applicable. . Submit a tax clearance on the real property.

affidavit of property value maricopa county what is an affidavit of property value arizona affidavit for collection of personal property affidavit of property value exemptions ars 11-1133 ars 11-1134 b 12 arizona affidavit form ars 11-1134 b3 affidavit of property value maricopa county what is an affidavit of property value arizona affidavit for collection of personal property affidavit of property value exemptions ars 11-1133 ars 11-1134 b 12 arizona affidavit form ars 11-1134 b3